David Wiselka • April 16, 2024

The Moundsville State Penitentiary boasts a rich and intriguing history with its gothic architecture that can send shivers down one's spine and...

Hunter Dodson • April 7, 2024

This past month, the American Cornhole League OPEN 11 took place at the Highlands Sports Complex in Triadelphia, West Virginia. The ACL OPEN...

December 7, 2023

December 7, 2023

November 4, 2023

October 12, 2023

David Wiselka • April 8, 2024

Placed in the heart of Wheeling, the Hempfield Tunnel, also known as "Tunnel Green," is a captivating and haunting structure that has stood the...

March 28, 2024

March 28, 2024

March 23, 2024

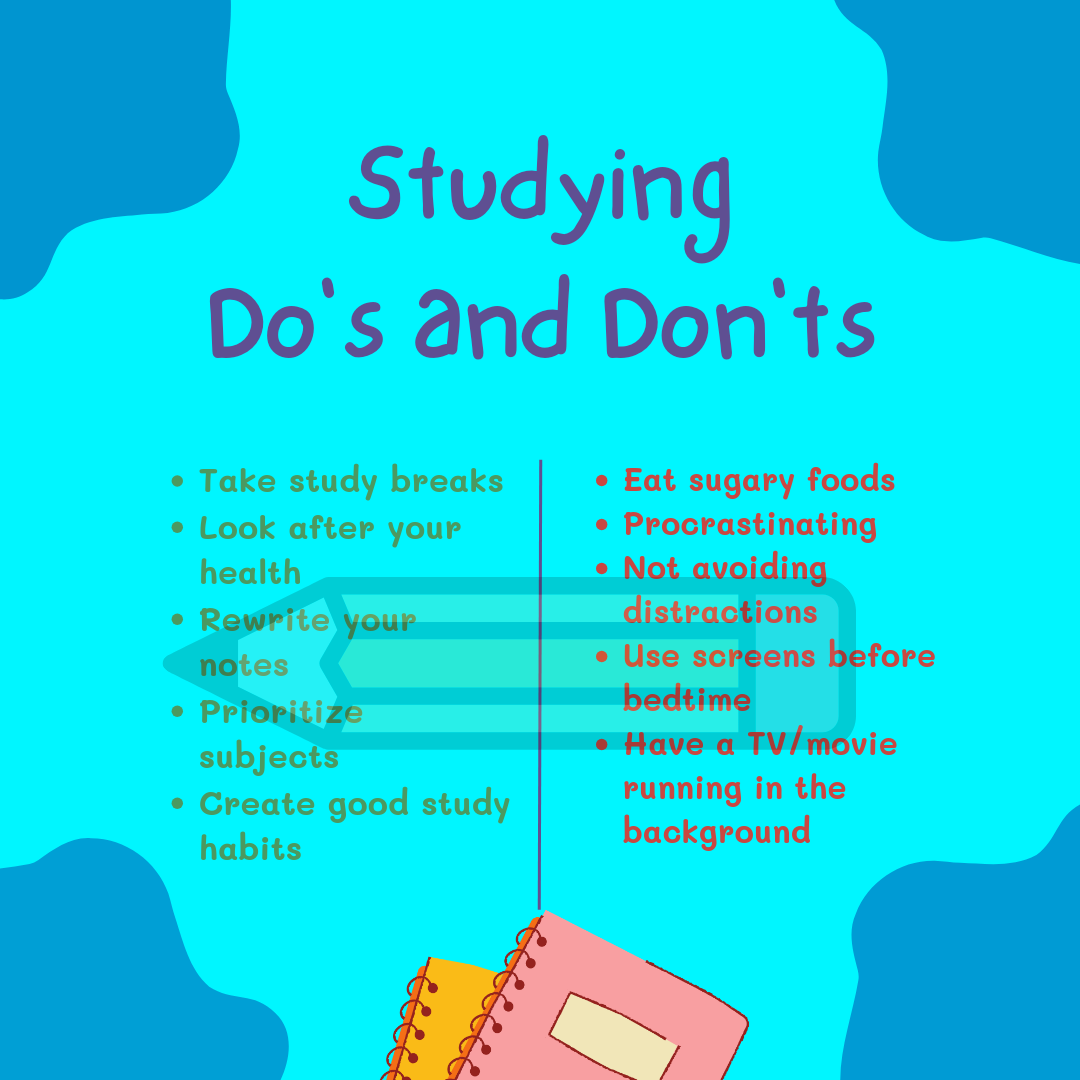

Finals week can be one of the most stressful weeks for college students. It is full of having to make sure all your assignments are completed...

October 2, 2023

October 21, 2022

October 3, 2022